Already familiar with the basics of GameStop? Scroll down to the header ‘And now?‘

Say “GameStop” and you will probably get one of these responses:

- “Isn’t that that company?”

- “Wasn’t something up with that?”

- “Oh yeah, that squeeze!”

- “Gamewhat?”

In this article we look back at the situation that happened around GameStop and take a look at what’s happening now.

Quick rewind

GameStop, founded in 1984 and publicly listed, is a retailer of games and entertainment products in the United States, but also in other countries in the world. Since January 2023 there are more than 4,400 GameStop stores. When the online era became bigger and bigger, ‘offline’ sales declined. Amazon became a big player in the field of online sales and the market share of GameStop decreased. This became so bad, GameStop was on the brink of bankruptcy, had a lot of debt, and management that didn’t innovate or anticipate on the potential of the games industry.

2021

Three years ago, in January 2021, something odd happened with GameStop’s stock. Its price rose to record highs, from below $20 to over $500.

At the end of August 2020 there was a big investor named Ryan Cohen who took a big interest in GameStop, buying more than 9 million shares.

Source: GameStop Rises on Investor’s Plan to Make It an Amazon Rival – Bloomberg

Cohen wasn’t an unfamiliar face in retail. Earlier he founded the company Chewy, beating Amazon in pet food and toys. After selling his company he became a billionaire at age 32.

Ryan Cohen had written a detailed letter to GameStop’s board of directors urging them to change things and pointed the board at its job to not waste GameStop’s value.

The stock’s price behaved differently and shortly after the biggest price increase in its history happened.

The green and red stripes are ‘candlesticks’ which show whether the price increased or decreased. What you see in the blue area are candlesticks being stretch out to the upside. At the right side you can see the stock’s price. At the top, the stock’s price was around $127. GameStop did a ‘stock split as dividend’ giving investors four shares for each one share they had. The stock’s price was divided by four as a result.

Price increases like that aren’t unique, they happen from time to time. The below is a short explanation of what a ‘short squeeze’ is.

When you buy a share with the expectation its price might rise, you’re ‘long’. You’re long a share.

When you expect the price to decrease you can ‘short’ it. This means borrowing a share from someone else and selling it. This can result in the price to go down. You have to return your borrowed share in the future to return to a net position of 0, or else you’re still negative. This is what they call ‘closing’ a position. It is the same as selling a share when you’re long, returning you to 0.

When there are a lot of shares sold short and the stock’s price increases, you’re suffering a loss. In order to limit your loss you have to return your borrowed shares by buying them back. Buying back a lot of shares causes the stock’s price to increase.

It can very much be there are multiple parties short on a stock, maybe at higher prices. When you buy and return your borrowed shares, the price might increase, causing shares that were shorted at higher prices to suffer a loss as well. This might lead to others returning their borrowed shares as well, causing the price to increase even further.

This can go on infinitely, basically ‘squeezing’ short positions, like an orange.

This is what you call a ‘short squeeze’.

GameStop was in a short squeeze (more on this later). However, GameStop wasn’t the only stock that increased. KOSS rose by 480%, AMC by 301%, NAKD by 252%, and EXPR by 214%. More on those later as well.

People became excited and GameStop became a game mania. Even Elon Musk took part:

Source: (2) Elon Musk on X: “Gamestonk!! https://t.co/RZtkDzAewJ” / X (twitter.com)

It is what happened after that what started a real saga around GameStop.

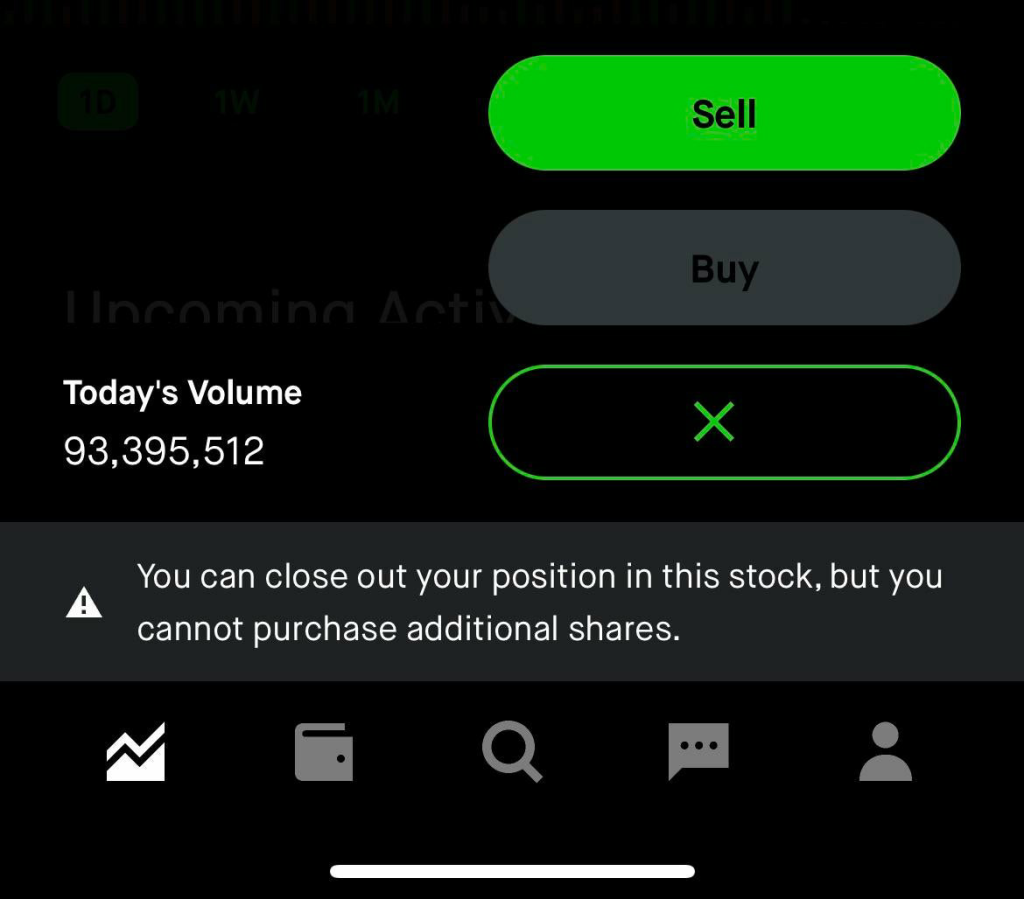

GameSTOP

Source: Robinhood restricts trading in GameStop, other names involved in frenzy (cnbc.com)

Source: 1/28/2021 – They Turned Off the Buy Button. Never Forget. : r/GME (reddit.com)

Shareholders weren’t able to buy GameStop shares anymore. When you can’t buy and only selling is allowed, the stock’s price can only go down. This is what happened and a lot of shareholders were astonished.

Imagine this: the price of a share increases and there is a lot of interest in it. This often attracts more interest, causing the price to increase even further. You want to participate, but can’t buy any shares. What?

The ball starts rolling

The situation was so extraordinary there were Senate hearings in the US, at which several parties had to answer questions regarding the GameStop situation. Among others Keith Gill spoke, online known as ‘Roaring Kitty’ or ‘deepfuckingvalue’, an investor who had done extensive research before the squeeze and concluded GameStop wouldn’t go bankrupt yet and they could play the new video game console generation (PlayStation 5, etc.). He also had faith in Ryan Cohen’s leadership.

Source: Congress plans hearings after GameStop stock frenzy and Robinhood trading freeze – CBS News

Media and the Senate accused Keith Gill of urging people to buy GameStop shares. Gill parried by saying he didn’t and he just liked the stock. When asked whether he would buy GameStop at its current price his response was positive. He doubled his position.

Detectives are born

Turning off the buy-button was cause for GameStop shareholders to begin researching. What had happened exactly? On social platforms Reddit and 4Chan people spent a lot of time investigating the background, why the buy-button was disabled, and what could happen in the future.

They discovered stock brokers, who let you trade shares, sell their data to market makers: the organisations that moves stocks using gigantic amounts of money. This is known as ‘payment for order flow‘.

Source: GameStop Saga Spurs Debate Over Payment for Order Flow Practice (wsj.com)

Shareholders also found out shares of stock aren’t safe with regular brokers because they are still borrowed to enable short selling.

As a result, shareholders started to use the direct registration system. This is a way to take your shares ‘out of the market’s pool’ and register in your name. When you would visit GameStop headquarters in Texas, you would find your name in the stock ledger.

People wrote manuals on how to register shares at whatever broker, in whatever country.

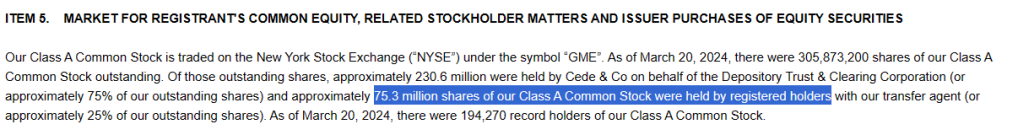

Remarkably, GameStop itself started publishing the amount of registered shares in their earnings releases. They also published the amount of shareholders.

In their latest quarterly/annual filing the following amounts were published:

Source: SEC Filing | Gamestop Corp. (gcs-web.com)

The amount turns out to be about 25% of the total amount of GameStop shares. They are owned by 194.270 shareholders.

The SEC (market overseers in the US) even published a report in which they investigated what had unfolded around GameStop. You can find the report using this link and it, among other things, mentioned the short interest. This is the amount of shares being shorted (borrowed and sold). The short interest was 84% in April 2020. In January 2021 it reached 122.97%. In short: all GameStop shares and 22.97% on top of that were sold short.

How is it possible there can be more shares sold short than there are shares of stock in a company? The SEC says this is the cause of short shares being lent out twice. They are borrowed and sold and the buyer of that share lends it out as well. This causes there to be two parties short for one share.

An important question is answers in the report:

Was this a short squeeze or was there something else happening?

Bless you!

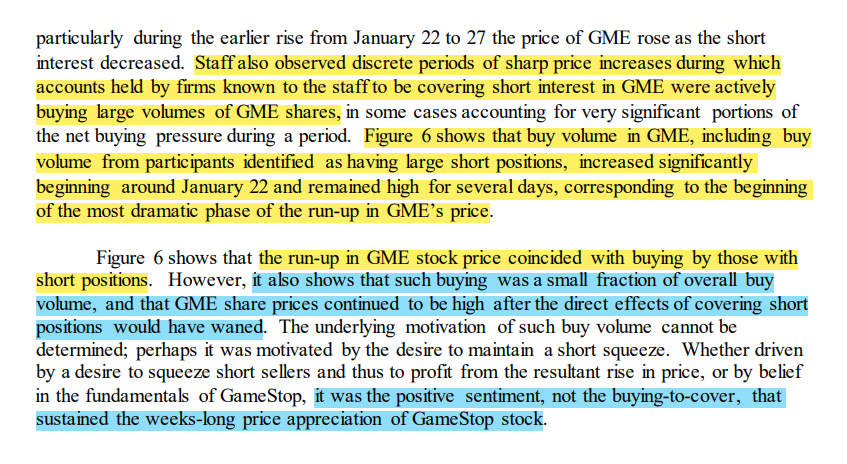

On page 26 of the report the following is written:

In yellow it says there indeed were short positions being covered, but in blue it is said the price stayed remarkably high while the direct effects of short positions being closed should have decreased.

“It was the positive sentiment, not the buying-to-cover, that sustained the weeks-long price appreciation of GameStop stock.”

Do note: in the explanation of what a short squeeze is the ‘closing’ of positions is mentioned. This means you’re not short or long anymore. When you ‘cover’ a position, you return your borrowed shares with newly borrowed shares. Your position is still open; you haven’t closed it.

On page 28 of the report one can find the image above, which is referred to in the yellow and blue piece. The red parts of the image indicate the buy volume of short sellers, while the blue areas show the total amount of buying volume. The dotted line is the average price per share weighed by the trading volume.

It sounds a bit difficult, but can we deduce from this image the buy volume to close or to cover positions was radically lower than the total buy volume?

Your answer to that question determines whether the extreme increase in price in January 2021 was a squeeze or something else. Loyal shareholders of GameStop call it the ‘sneeze’.

Behind the scenes

Slowly but surely the parties behind the short selling become known. One of the biggest parties, Citadel, is a market maker and hedge fund at the same time (which is interesting: providing the market with liquidity while investing in the market at the same time). During the sneeze of January 2021 they invest $2.75 billion in investment fund Melvin Capital, which is heavily short in GameStop.

Source: Citadel billionaire Ken Griffin defends Melvin stake against ‘insane’ theory (cnbc.com)

Some time later Melvin Capital decides to shut down because of heavy losses. Citadel takes a big chunk of its investment back and there you have it: one participant fewer.

Another investment fund is Point72. Also short in GameStop, also a helping hand to Melvin Capital. A while later it becomes known Point72 has taken a small stake in GameStop, albeit for a short time.

The above players, including the CEO of stock broker Robinhood, take part in the Senate hearings. During the hearings they state there weren’t any agreements or connections between the different investment funds.

Below an interesting fragment with several screenshots of conversations… between those parties.

“…pushing the price into the thousands.”

The CEO of Interactive Brokers, Thomas Peterffy, discusses the GameStop situation and explains what happens when too many shares are sold short, how those shares have to be bought, and how this could have launched GameStop’s stock price into the thousands of Dollars. This would have had catastrophic consquences for the market. “You end up with a complete mess that is practically impossible to sort up. That’s what almost happened.”

You can find the fragment here:

Short and distort

- Toys ‘R Us

- Radioshack

- Blockbuster

- Sears

- JC Penny

- Lehman Brothers

These are companies which went bankrupt because of mismanagement. At least, that is the general thought behind it. A technique which played out behind the scenes is known as ‘short and distort’. This is a way to destroy a company by selling its shares short and spreading rumours and negativity, causing the share price to decrease. This goes to such lengths, the company can be removed from the exchanges. The short sellers take big profits. Unrealized profits. That is because when a company goes bankrupt while you have a short position in it and you don’t close that position, you won’t have to pay taxes.

This has even caused a lot of companies to be destroyed of which shares of stock still exist on the exchange, the so called ‘pink sheets’. This is where companies go that don’t meet the requirements of the big exchanges. Shares of those companies are traded ‘over-the-counter’, as if you were buying them at the counter of a thrift shop. There is less oversight and there are fewer rules on over-the-counter shares.

To crush the stock’s price, a ton of shares are sold short so the actual amount of shares is being diluted. This dilution isn’t visible, only a high short interest is present while there are also a lot of synthetic shorts: fake shares, not even visible.

When nothing is done by the company to prevent this, except for doing stock splits (creating even more shares) and offering extra shares (to raise some money), you end up with a massive dilution. It is almost impossible to increase the stock price. The stock has been punched into the cellar. This technique has name: cellar boxing. The stock is stomped below the required level to be registered on the big exchanges after which it is removed.

The stock is as good as dead.

Zombie stocks

And that is how you get zombie stocks. Getting back to the previous list of companies:

- Toys ‘R Us

- Radioshack

- Blockbuster

- Sears

- JC Penny

- Lehman Brothers

They are companies that have been cellar boxed, while still trading in the over-the-counter markets. The following images are screenshots of their stock’s prices:

Those companies have another thing in common.

BCG. The Boston Consulting Group.

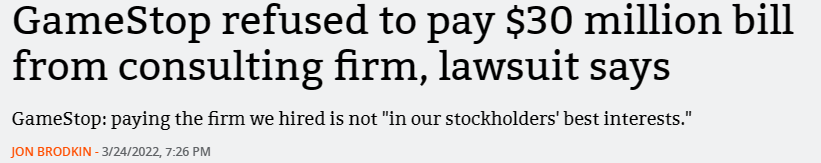

Each of the companies above has been advised by the Boston Consulting Group. They advise in certain ways that eventually leads to the downfall of the company. GameStop was one of the companies advised by the BCG, before Ryan Cohen stepped on board.

Source: GameStop refused to pay $30 million bill from consulting firm, lawsuit says | Ars Technica

Cohen and friends made the old management disappear, including BCG’s infiltrator who was destroying GameStop from the inside out.

The BCG offered advice at premium prices. They sued GameStop for breach of contract. Eventually the accusations were dismissed.

Source: Breach Of Contract Claims Trimmed In $30M GameStop Suit – Law360

Forget GameStop!

What do you do when you want someone to forget about a certain thing? That’s right, you won’t ever mention it again.

Then why is GameStop constantly bashed in the media, even three years after its big increase in price? You can still find articles like the ones below up to this day:

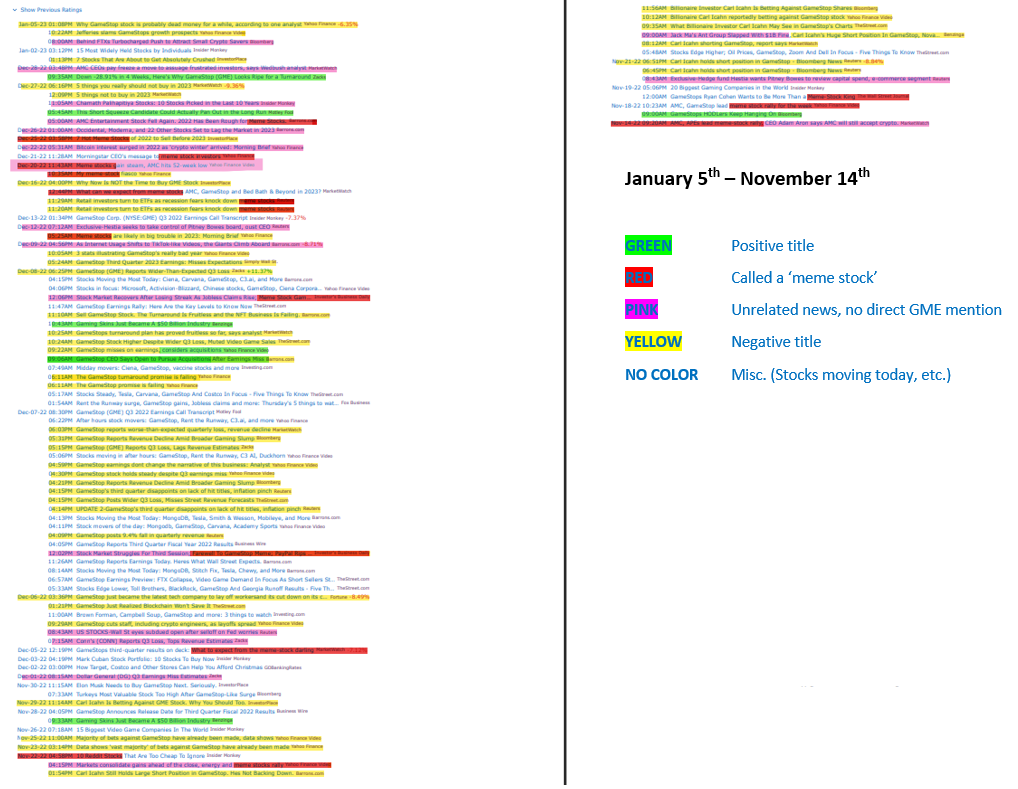

This is another list of articles from 2022, a year after the sneeze:

The image below shows even more articles from 2022, showing what kinds of news were published about GameStop:

In yellow the negative articles, in green positive articles. Besides that red articles calling GameStop a ‘meme stock’. This is another interesting topic.

Meme stocks

A meme is an internet joke, something funny or dumb. When a stock is called a meme stock it is associated with a joke or something dumb. Because GameStop is popular and connected to Reddit and 4Chan, it is associated with memes. Even now media calls GameStop a meme stock:

The reasoning behind this is discrediting GameStop. Serious investos don’t want to invest in memes. When somebody is called a clown, there is a great chance they are seen as being the opposite of serious.

Difficult words to make things difficult

There is a lot of speculation about the ways GameStop’s stock is manipulated. Merely selling shares short isn’t hidden enough. Options have been used as a way to leverage extra shares in order to influence the stock price.

Around the 2007/2008 crash in the mortgage market big parties made use of derivatives. The size of this derivatives market in 2024 is much bigger than the one in 2008.

There’s also speculation about swaps. These are financial products through which two parties can exchange products, including risks and rewards. A short explanation:

John is a cow farmer. He has more profits, but also higher risks because of diseases, the price of animal feed, and the rules surrounding animals.

Bob is a corn farmer. He has fewer risks, but also less profit because the price for corn is low.

John has a feeling there’s a disease coming which will impact his profits. Bob is in need of more profits, so both farmers decide to exchange products. They swap each other’s profits, but also the risks.

GameStop is the subject of swaps. Multiple ‘meme stocks’ are thrown in a basket through which their stock’s prices are influenced. It has happened several times GameStop stock price made the same moves as other stocks. Almost 1-on-1 price action. This is because of so called basket swaps. They are connected with each other and where one increases, the other does as well.

These swaps appeared in the news through Archegos:

Source: How many funds are a margin call away from failing like Archegos? (qz.com)

Archegos was a money manager with so much leverage, they were exposed to a gigantic position. They were hit by a margin call (“you have to put in more cash or else we have to close your position!”) which they couldn’t survive.

Source: https://www.reuters.com/legal/archegos-founder-hwang-must-face-sec-fraud-charges-2023-09-19/

A fire sale of shares used for the swaps began and banks were forced to sell their positions. Credit Suisse was one of the exchanging parties of those swaps and suffered great losses. Such great losses, UBS had to take over their burden. UBS later revealed their first loss ($785 million) in years.

Source: Total bank losses from Archegos implosion exceed $10bn (ft.com)

Not only was there a lot of trouble in the world of banking, there has also been uproar in the world of crypto. Crypto platform FTX, led by Sam Bankman-Fried committed fraud by using money from investors for FTX. The money from investors came from a firm called Alameda Research.

Source: FTX’s Sam Bankman-Fried appeals conviction and 25-year sentence for fraud | Crypto News | Al Jazeera

People were able to trade a token on FTX which was based on GameStop stock. This ‘tokenized stock’ was supposed to be covered 1-on-1 by GameStop shares. Was this the way for short sellers to get rid of shorted shares?

You can find a link to a fragment in which the 1-on-1 tokens are discussed here: GameStop token at FTX

Notable is that former president of FTX, Brett Harrison, had an executive role at Citadel (one of GameStop’s shorts).

Source: One Man Connects FTX, Citadel and the Crypto Market Crash | InvestorPlace

The transformation

Back to GameStop itself. After Ryan Cohen getting on board, several switches in management, and Ryan Cohen becoming Chief Investment Officer (allowed to invest GameStop’s cash) besides his roles as CEO (salary: $0) and chairman of the board of directors, GameStop had been working hard at decreasing costs, closing stores which didn’t make money, and improving their online ecommerce presence.

As a project GameStop built a store for NFTs, non-fungible tokens, which are unique objects trading on the blockchain, something that is going to be important in the future. The ‘NFT marketplace’ was put online as a beta/test version. Unfortunately GameStop decided to close it because of uncertainty regarding crypto legislation in the USA.

Source: Web3 Watch: GameStop waves goodbye to NFT marketplace – Blockworks

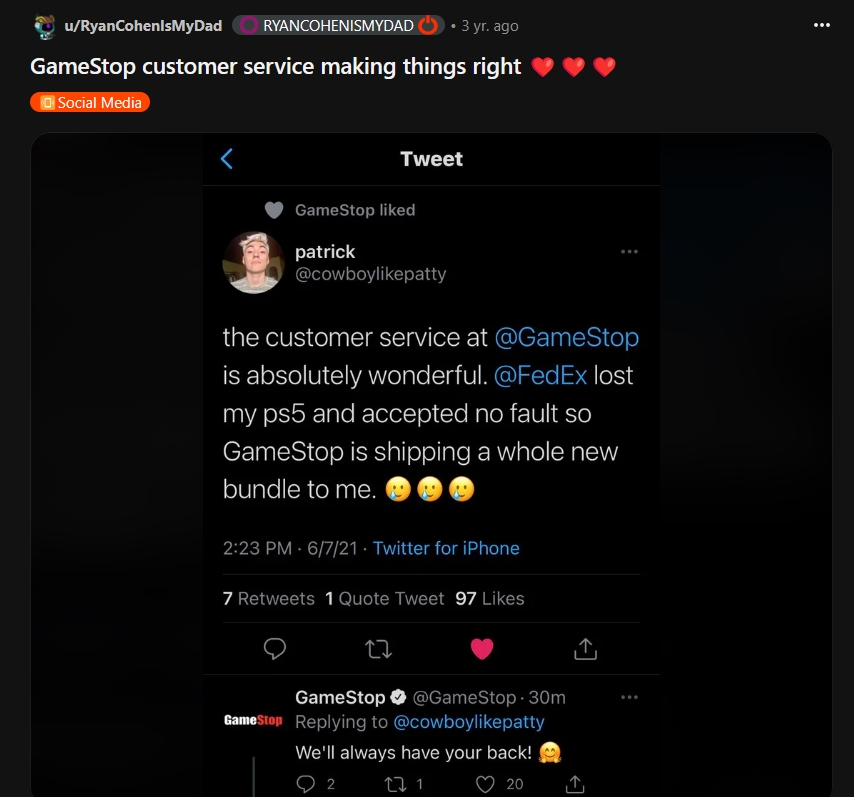

The online and commercial presence was further increased by launching a new website and building fulfillment centers. GameStop was hard at work at creating something that had made Chewy great (Cohen’s former company) providing an excellent customer experience. An example of what that is:

Source: Twitter

Source: GameStop.com

In interviews with Ryan Cohen it is made clear he has a few core values which made Chewy a great success and have to do the same with GameStop. “Underpromise and overdeliver” and “don’t judge GameStop by their words but judge them on their actions” are some the most important ones.

And now?

On March 26 2024 GameStop published earnings for the final quarter of 2023 and fiscal year results. It turned out GameStop had less revenue than in the same quarter of the previous year and fiscal year.

However, something else had happened.

For the first time since 2018 GameStop had become profitable. A loss of $300 million had been turned into a profit of $6 million; a turnaround of $306 million.

The stock’s price dropped 15% after not meeting analyst expectations and further dropped 35% to price levels previously seen in February 2021, when GameStop was a different company from what it is now.

Besides profitability GameStop has $1 billion in cash on hand, raised by offering shares when its stock’s price was higher. The only debt that remains is a small interest covid-related loan for its French branch.

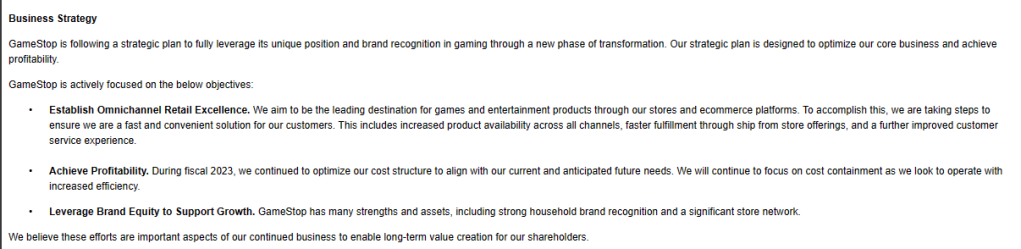

According to GameStop’s objectives, published in their most recent annual report, objective two has been completed:

Source: SEC Filing | Gamestop Corp.

GameStop’s focus is on generating new revenue streams. They recently began with the launch of a new line of customizable controllers called CandyCon:

The thesis for shorts before 2021 was one in which GameStop would go bankrupt. With the shift in management, the profitability, the billion in cash, and the loyal shareholders one thing is certain:

GameStop is not going bankrupt.

The short sellers are stuck.

M.O.A.S.S.

According to GameStop’s loyal shareholders there has never been a real squeeze and because of the remarkable events that have happened and continue to happen there is a squeeze to come. However, after three years in which:

- a huge chunk of GameStop’s shares were registered and removed from the pool,

- shorts are still selling shares short each and every day,

- GameStop will not go bankrupt and is working hard at building bigger profits and revenue,

one could say the situation that started in January 2021 has become much, much bigger. The pressure in boiler is drawing closer to explode.

Because of all the events and the manipulation in the market, shareholders aren’t willing to let go of their precious shares. January 2021 prices won’t cut it. If prices could have reached into the thousands back then, imagine what prices they can reach this time around.

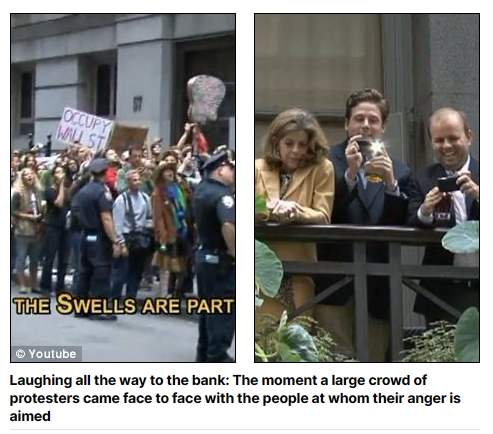

People want Wall Street to pay.

The mortgage crash and banking crisis of 2008 was caused by greed and the Occupy Wall Street movement of 2011 started out of protest, regular investors are fed up with Wall Street’s activities.

Wall Street has been caught red-handed.

When a squeeze happens it won’t be an ordinary short squeeze. When there are no more shares available and shares are sold short several times over, but the demand is many times the supply, the bidding price has to be increased so much people are willing to let go of a few shares.

This gigantic imbalance in supply and demand, through which all shorts will be squeezed, will be known as the M.O.A.S.S.

The Mother of All Short Squeezes.

Closing remarks

Summarizing all the events surrounding GameStop over the span of three years is impossible. It is a story filled with details and nuances. The best way to learn more about GameStop is by conducting research. A great starting point is Reddit, where GameStop shareholders share information and updates in a community called Superstonk.

A small grasp of some of the most popular posts:

There even is a whole digital library with most important documents, speculation, and theories collected.

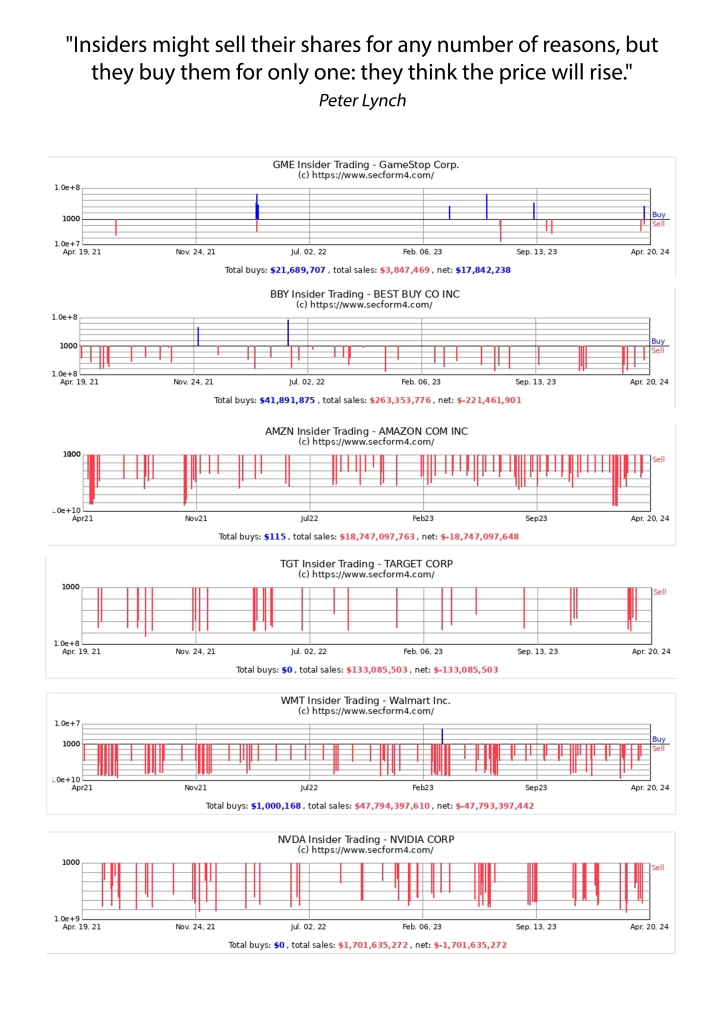

Here’s an overview of insider trading in GameStop, its biggest competitors, and one current and one former market leader. The red color indicates selling by insiders, while the blue color shows insider buying. The red color can also include selling for tax purposes. Notice any differences between GameStop and the other companies?

If you want a great movie recommendation that showcases the GameStop saga you should watch The Big Short. Including a cast of Hollywood heavyweights, this movie describes the events before and after the mortgage crisis of 2007/2008. It basically tells the story of what’s happening with GameStop now, but with reversed roles (GameStop longs now being the short sellers in the movie, and GameStop short sellers being the long buyers in the movie).

DISCLAIMER

This article was written from the vision and opinion of one person with a stake in GameStop. This articles was written for educational and informational purposes. The article is no financial advice and does not claim to be. When you invest or trade in stocks or other financial products you can be at a lot of risk and suffer losses. It is important to conduct your own research and seek independent advice before making decisions regarding investments. The writer of this article is not responsible for any damage or losses resulting from usage of the provided information or the trust in this information for trading or investing decisions.

Comments

2 responses to “The GameStop saga explained: an unprecedented risk… for the world”

[…] related to the Reddit and 4Chan platforms. The full reasoning behind the bashing can be read in our article summarizing the GameStop saga so […]

LikeLike

[…] The GameStop saga explained: an unprecedented risk… for the world – SandersonClay […]

LikeLike