The whole saga surrounding GameStop has been going on ever since 2020 and is still going strong with weird, interesting, obscure, and amazing things happening often. Step back in time with us as we take a look at things that have happened during the saga. How many of them do you remember?

The SEC meme stock video

The Securities and Exchange Commission launched a video that advertises researching stocks, which is great advice. However, they put a negative spotlight on GameStop, which has been slandered in the media as being a meme stock.

Dave Lauer of Urvin Finance put it well:

The video in question:

The most awarded post in Reddit history

u/deepfuckingvalue on Reddit, also known as Keith Gill, the original GameStop investor who saw its value where others didn’t, used to post his GameStop position on Reddit and update it ever so often. His posts became legendary and received thousands of so-called ‘awards’, which can be awarded to users with cool or interesting posts to put them in the spotlight.

His final position update, after he appeared before the U.S. Senate, became the most awarded post on Reddit.

Unfortunately the awarding system has been removed from Reddit so awards can’t be seen anymore.

The second most upvoted post in Reddit history

When you visit the ‘all’ page of Reddit and filter the posts by ‘top’ of ‘all time’, you will notice the second most upvoted post (485,000 votes) is about GameStop. In fact, it shows a huge billboard on Times Square in New York City with a reference to GameStop during the sneeze run-up in January 2021.

A faulty applause track

Ken Griffin, Citadel founder and CEO, spoke at the economic club of Chicago in 2021. A clip emerged of him talking and receiving applause, but the applause seems to be cut and repeat itself. Almost as if an applause track was used. The original video doesn’t include the repeat making you wonder whether the clip was fake or the original video was edited.

Here’s the clip: Ummmmmmmm, is that an applause track they just accidentally played? : r/Superstonk (reddit.com)

The original video can be found here, at the 04:35 mark: Original video Economic club Chicago 2021

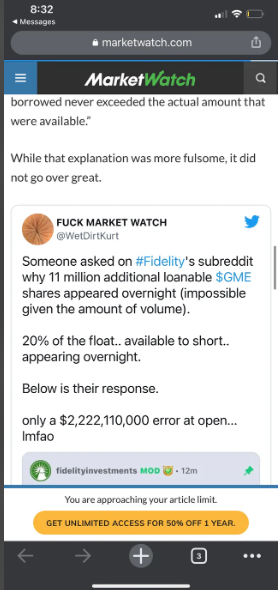

A picture of a black hole

The website MarketWatch published an article on an error made by Fidelity regarding millions of additional loanable GME shares appearing overnight. This post included a tweet by someone who changed their profile picture to a butthole, making it appear in the MarketWatch article. There is a post by u/wetdirtkurt showing it that can be found on Reddit.

The Bartlett warehouse fire

A warehouse in Illinois, U.S.A. caught fire. This wouldn’t have been out of the ordinary if not for the circumstances. The warehouse was used to store documents for TD Ameritrade. The fire happened shortly after the US Justice Department announced expanding investigation to target 60 short selling firms.

Apparently some of the shelves in the warehouse fell over, stopping the sprinkler system from working.

Whatever the facts, where there is smoke, there is fire. That’s a fact!

Mark Cuban AMA

Around the time GME’s share price was sneezing upwards, Mark Cuban, billionaire extraordinaire hopped on Reddit to do an interview with its community. This is called an AMA: Ask Me Anything. Of course, a lot of questions were asked about his thoughts regarding the GameStop situation and this was Cuban’s legendary response:

He basically predicted things that would happen in the future: there are funds and big players that have shorted the stock again thinking they are smarter than everyone. Hold the stock if you can afford it and the lower it goes, the more powerful you can be in buying the stock again. In a later comment he said “When I buy a stock I make sure i know why Im buying it. Then I HODL until till I learn that something has changed. THe price may go up or down, but if i still believe in the logic that made me buy the asset, I dont sell. If something changed that I didnt expect , then I look at selling.“

When asked about the SEC and regulations, he responded with:

The SEC is a mess. I wouldnt trust them to do the right thing ever. Its an agency built by and for lawyers to be lawyers and win cases rather than do the right thing

If the SEC gave a shit about ANYONE other than Wall Street you would be able to go there right now and read bright line guidelines about insider trading, shorting, what is a pump and dump, what are the rules for cutting off the purchase of stocks like happened with GME et al

But they wont. They would rather litigate to regulate, which means they love to sue people in order to create new legal precedents.

All you need to know about the SEC and how badly they want to fuck the little guy is that they have the option of using JUDGES THAT WORK FOR THE SEC when they sue you rather than you have the option to have jury of your peers in front of a judge that is independent . Thats how bad the SEC is. If you want fair markets that doesnt benefit Wall Street call your local politician and show them this

Another interesting response from Cuban:

As a final note, Mark Cuban also commented on the possibility of shorts never covering or closing their shorts at all. This is what he said:

Their goal is to never cover their short. But that would take the company going out of business or being delisted. That wont happen here.

Best thing you can do is hold on to the stock and do business with GameStop. If everyone goes to their website and buys from them that is going to help the company which will help the stock which will help everyone here.

If you still believe in the reason you bought the stock, and that hasnt changed, why sell ?

Mark Cuban

Office coke video

Someone with a drone managed to film an office building at night, where two employees were hard at work doing desk related stuff. It’s unclear whether the employees were actually doing what is presumed, but it seems like they were hard at work writing lines.

The recording of the event: Citadel Employees Doing Coke (youtube.com)

Gorilla sanctuary good will

As a way to pay it forward, Redditors (and potentially others) ‘adopted’ gorillas at an ‘ape’ charity called Dian Fossey Gorilla Fund. They even received a message from the director of the fund thanking them for their support.

The Wu-Tang Clan NFT dividend theory

There was a theory around the time GameStop was working on the NFT marketplace where news appeared of the legendary Wu-Tang Clan album ‘Once Upon a Time in Shaolin’ being bought by a group of collectors called PleasrDAO.

Note the person with the backwards hoodie in the picture:

Looked awfully similar to a certain CEO’s hoodie who was building an NFT marketplace:

Theories speculated GameStop might issue NFTs as a dividend to celebrate its marketplace and follow the example of the company of Overstock, which had previously issued a digital dividend. The Once Upon a Time in Shaolin album is unique and NFTs are unique by themselves, making for a very interesting theory.

Short interest calculation changes

GameStop’s short interest was 122.97%, more than 100%, according to the SEC report.

The SEC (market overseers in the US) even published a report in which they investigated what had unfolded around GameStop. You can find the report using this link and it, among other things, mentioned the short interest. This is the amount of shares being shorted (borrowed and sold). The short interest was 84% in April 2020. In January 2021 it reached 122.97%. In short: all GameStop shares and 22.97% on top of that were sold short.

The GameStop saga explained: an unprecedented risk… for the world – SandersonClay

Apparently, the way the short interest is calculated was changed some time later, causing short interest percentages to not exceed 100% again.

Some further reading:

- The Smoking Gun : r/Superstonk (reddit.com)

- Reminder: It was S3 that changed the short interest formula, not Ortex : r/Superstonk (reddit.com)

- FINRA Changed How They Report Short Interest This Week : r/GME (reddit.com)

$GMED

There was a Reddit user who apparently fat fingered a buy order of… GMED, instead of GME. Lucky for him, price increased by 35% over the next months:

“Oops, MOASS”

A tweet from the GameStop twitter account about an upcoming edition of an older game franchise added some spice:

The franchise in question is ‘Mass Effect’, but an enthusiastic social media person added a reply that changed the word mass into moass, a reference to the ‘mother of all short squeezes’.

Victor from California

A caller appeared on Jim Cramer’s Mad Money TV show where he first complimented him and then proceeded to say he bought more GameStop and Bed Bath Beyond shares. Jim Cramer was speechless.

“Shorts never closed, BOOM!”

The Bluprince GoFundMe

Reddit user u/BluPrince theorized a possible ‘infinity pool’: a bundling of shares that are never sold and won’t be able to be used for short covering or closing, thus keeping the share price ridiculously high.

The news broke u/BluPrince passed away and in honor of his name, people started donating to a GoFundMe and giving away food and gift cards, what u/BluPrince used to do himself as well.

A lot of other things have happened in those 3+ years. They might be included in a future post. Which things you missed in those one have to be included in a future one? Let us know in the comments!

2 responses

-

I ‘member the moment where Gamestop tweeted GS astronaut on the moon chilling with a Carlsberg and started OWNING its social media (11 May 2022) …

Or where CNBC censored out Dennis Kelleher’s testimony during the Second Congressional Hearing where he calls out Citadel/Shitadel posing a systemic risk to the market when (not if, WHEN) they will go under (17 March 2022) …

Or when CNBC’s Melissa Lee said Naked Shorts Yeah on live television with Pikachu shocked face afterwards (05 June 2022) …

And soo much more!

LikeLike

-

Great ones, thank you for those.. and for the memories!

LikeLike

-

Leave a comment